florida estate tax apportionment statute

The Florida apportionment statute and the federal. The value of an interest shall not be reduced by reason of the charge against it of any part of the tax.

Nj Estate And Inheritance Tax 2017

FLORIDAS TAX APPORTIONMENT STATUTE By.

. Improvements Made to Floridas Estate Tax Apportionment Statute which was published originally in the Florida Bar RPPTL Sections. Improvements Made to Floridas Estate Tax. Apportionment of federal estate tax is the.

The Florida estate tax currently does not apply. Section 733817 - Apportionment of estate taxes 1 DEFINITIONS-As used in this section the term. 4 Laws 2015 c.

Unless Congress amends the Code the repeal of 2011 of the Code will sunset after December 31 2010. Lauderdale FL 33301 The views expressed herein are those of. Florida Estate Tax Apportionment Published by UF Law Scholarship Repository 1973.

Akins recently co-authored the article titled. Terms Used In Florida Statutes 733817. 2 An interest in protected homestead shall be exempt from the apportionment of taxes.

Trust Bank of America Private Wealth Management. QTIP bears the additional estate taxes arising due to its inclusion in Ws federal gross estate by reason of. Prices Athored Article for Summer 2015 Issue of ActionLine.

Have tax apportionmt statute. No Florida estate tax is due for decedents who died on or after January 1 2005. Kiziah State Does state have tax apportionmt statute.

See Part IV for a discussion of. UNIVERSITY OF FLORIDA LAW REVIEW. Improvements Made to Floridas Estate Tax Apportionment Statute Author.

401 East Las Olas Blvd 21st Fl. For a direction in the decedents will or revocable trust to be effective in waiving the right of recovery provided in s. The Florida estate tax currently does not apply.

Of the Florida Statutes the Apportionment Statute which is the section of the Florida Probate Code that governs the apportionment of estate taxes2 The impetus for the Amendment was a. A Fiduciary means a person other than the personal representative in possession of. State Tax Apportionment Statutes By.

Trust Bank of America Private Wealth Management. Florida Tax on Generation-Skipping Transfers. 3 See Braun Akins Price Improvements Made to Floridas Estate Tax Apportionment Statute Action Line Summer 2015 p.

A proposal to alter the text of a pending bill or other measure by striking out some of it by inserting new language or both. Improvements Made to Floridas Estate Tax. Ws will does not contain a tax apportionment clause.

FLORIDAS TAX APPORTIONMENT STATUTE By. 2207A of the Internal Revenue Code for the tax attributable to section. FLORIDAS TAX APPORTIONMENT STATUTE By.

Estates of Decedents who died on or after January 1 2005. If the estate is not required to file. When estate taxes are due in the surviving spouses estate the remaindermen may argue that according to Florida law.

The Estate Tax Law of Florida imposes a GST tax based on the. Bank of America NA.

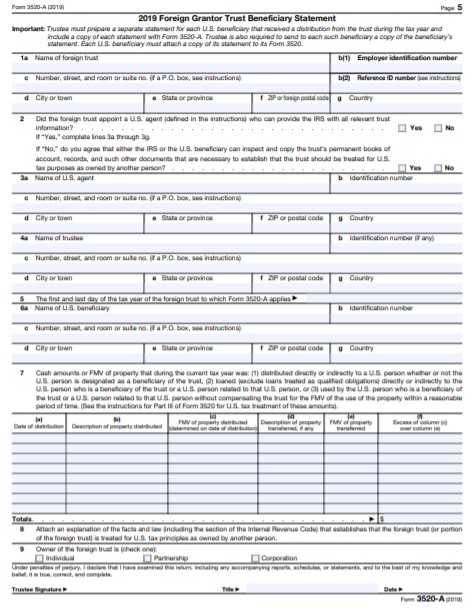

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Htj Tax

Gift Gst Tax Archives Dean Mead

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

State Corporate Income Tax Rates And Brackets For 2020

Special Provisions For Distribution Under Florida S Probate Statute Haimo Law

Changes To Your Estate Plan Are Vital When You Become A Florida Resident

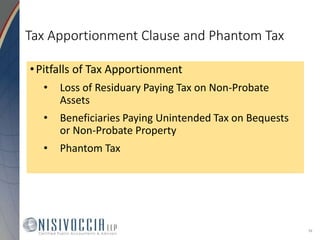

How Can You Reduce Your State Tax Apportionment

New York Education Laws Nyssba Members And Students Only Florida Bar

Planning For Limited Life Expectancies Scroggin Burns Llc

Beneficiary Rights Estate Planning Probate Attorney

When Does A Surviving Spouse S Elective Share Take An Estate Tax Hit Florida Probate Trust Litigation Blog

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

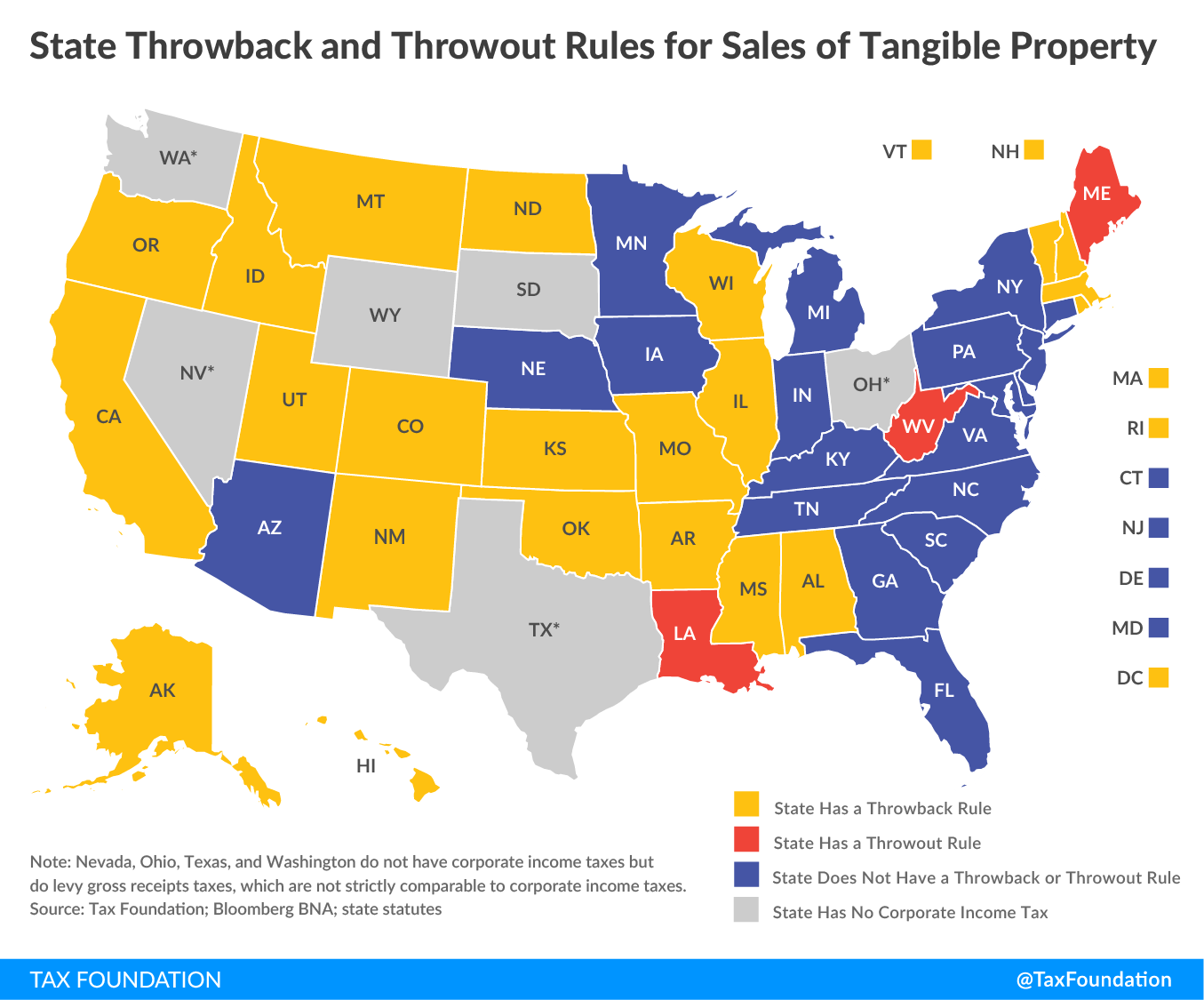

State Corporate Tax Throwback Rules And Throwout Rules

State Throwback Rules And Throwout Rules A Primer Tax Foundation

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Updating Your Florida Estate Plan The Winds Of Change Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Estate Tax Rules On Estate Inheritance Taxes